If you are currently enrolled in Medicare but find yourself uncertain about whether a Medigap plan or Medicare Advantage plan would be more suitable for your needs, the Kendall Chanley Agency is here to help! Here’s a comprehensive breakdown of both options, enabling you to make a well-informed decision regarding your Medicare coverage.

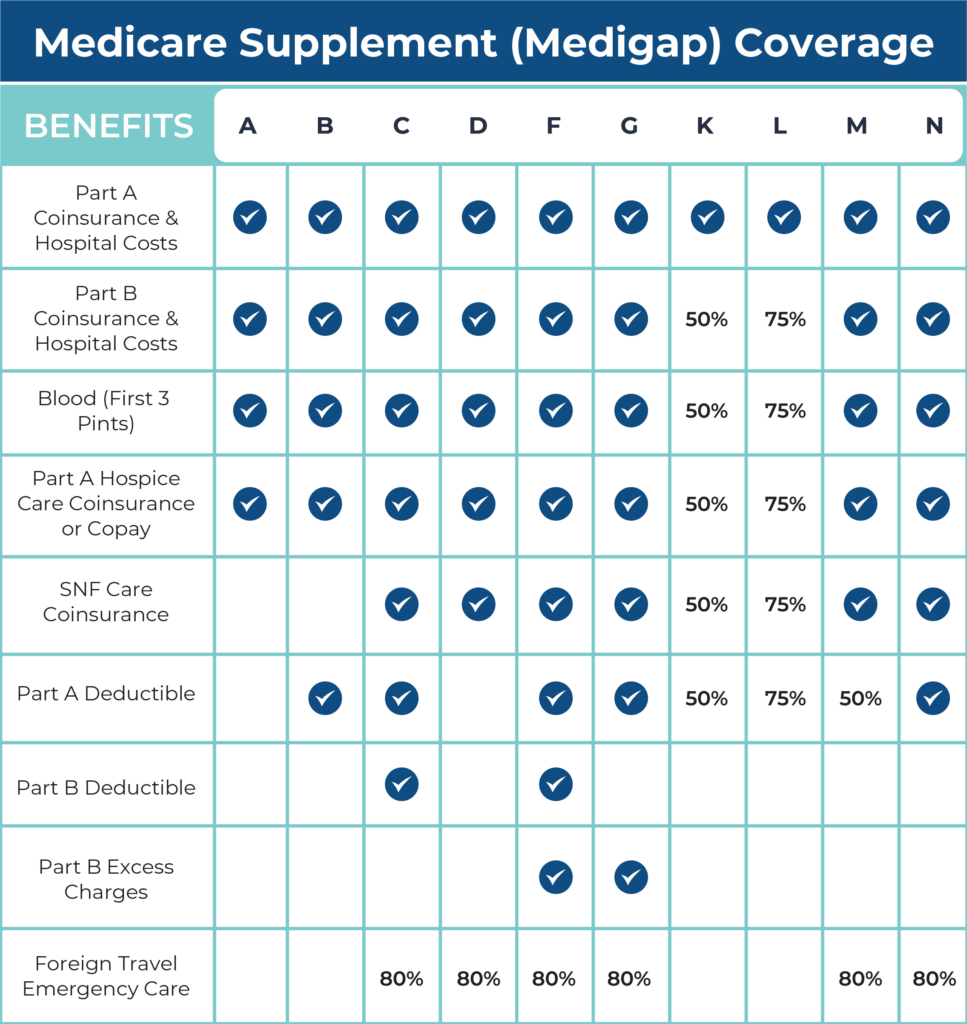

There are a total of 10 Medicare Supplement (Medigap) plans available that can supplement your Original Medicare (Part A and B) coverage. The type of Medigap plan that is right for you will ultimately be based on the type of coverage you are searching for. Below is a breakdown of what each Medigap plan covers:

*The 2023 out-of-pocket spending limit for Plans K and L are $6,940 and $3,470.

Don’t let the complexities of Medicare overwhelm you. Contact Kendall Chanley to take the first step towards securing the right coverage!

While Medigap is a supplemental option for Original Medicare coverage, Medicare Advantage (Part C) plans are recognized as alternatives to Original Medicare. Medicare Advantage plans must adhere to Medicare’s regulations, ensuring they offer the same coverage as Original Medicare. However, some Medicare Advantage plans may provide additional benefits, such as dental, hearing, vision, and prescription drug coverage.

The Medicare Advantage plan available to you will depend on your eligibility and location. Here are the most common types of plans available:

HMOs are cheaper than other Medicare Advantage plans. They require plan members to use their in-network providers and choose a primary care doctor.

PPOs offer more flexibility. You can use out-of-network providers but at a higher cost. Plan members don’t have to choose a primary care doctor or get referrals to see specialists.

SNPs are for those who are dually eligible for Medicare and Medicaid (D-SNP), have chronic and disabling conditions (C-SNP), or are living in an institution (I-SNP).

PFFS plans negotiate what you will pay and what they will pay for every visit, giving you the benefit of knowing what your costs will be beforehand. You can see any doctor who accepts the terms and conditions of your PFFS plan.

MSA plans use a savings account and high deductible plan to pay for medical costs.

With her wealth of expertise and extensive resources, Kendall Chanley is well-equipped to guide individuals in making educated decisions when faced with the choice between Medigap and Medicare Advantage. Kendall’s commitment to her clients shines through in her personalized approach, ensuring she understands their unique needs and concerns. She takes the time to thoroughly explain the intricacies of both options, empowering her clients to make informed decisions about their healthcare coverage.

With Kendall by your side, you can trust that she will go above and beyond to provide you with the support and guidance needed to navigate the complexities of Medicare insurance. Her dedication, knowledge, and genuine care for her clients make her an exceptional advocate and advisor in the world of Medicare.

Ready to get started finding the Medicare solution that works for you? Book an appointment with Kendall today!

Don’t let the complexities of Medicare overwhelm you. Contact Kendall Chanley to take the first step towards securing the right coverage!